| | | | Dear readers, CDU/CSU and SPD agree: the German economy must be strengthened. The coalition agreement commits to some right and important starting points for the aviation industry. What matters now is turning words into action. Relief measures and fair regulatory conditions are essential for Germany to regain its international competitiveness as an aviation location. Europe must also find new answers. High regulatory costs, competitive distortions, and bureaucracy must be reduced. Otherwise, European aviation is at risks of falling further behind – at the expense of jobs, value creation, and connectivity. To secure Europe's sovereignty in the long term, a new, coherent EU aviation strategy is needed. The necessary course correction also includes climate protection. EU airlines must no longer be disadvantaged compared to non-EU carriers. When it comes to decarbonization through sustainable aviation fuels (SAF), progress has been limited – particularly with power-to-liquid (PtL) fuels. Production costs remain too high, and volumes are far too small. The EU must adopt a new regulatory approach here, too. Quotas alone are not enough to enable a successful market ramp-up. Enjoy the reading! Andreas Bartels

Head of Corporate

Communications

Lufthansa Group | Dr. Kay Lindemann

Head of Corporate

International Relations and

Government Affairs

Lufthansa Group

|

| |

| | | | Coalition agreementImportant signals for the aviation industryCDU/CSU and SPD agree: Germany must become competitive again. The coalition agreement contains several positive impulses for the aviation industry. It is important that tangible relief comes soon.

In their coalition agreement, CDU/CSU and SPD are sending an important signal for the German aviation industry. They are committed to the growth and modernization of the industry and announce some first steps to strengthen Germany as an aviation location. This is imperative, as the disproportionately high taxes and charges place a massive burden on companies in international competition. Location costs must be reduced

Reversing the increase in aviation tax is a correct first step that must be implemented promptly. However, this must not be the end of the matter. Further relief is urgently needed. This expectation has also been expressed by the Conference of German Minister Presidents. The burden of aviation security and air traffic control fees must be brought down to a competitive level – for example, by the federal government bearing half of the costs for control personnel. With regard to air traffic control, the announced support should not be limited to regional airports. After all, as it is primarily the hubs in Frankfurt and Munich that have to hold their own in international competition. Climate protection must be competition-neutral

The fact that CDU/CSU and SPD are calling for equal treatment of European and non-European airlines with regard to the EU-SAF quota, is to be expressly welcomed. In its current form, the quota severely disadvantages European carriers compared to their non-European competitors. The consequences are traffic shifts out of the EU and carbon leakage. The review phase of ReFuel EU Aviation must therefore be used in a targeted manner to achieve a competition-neutral solution. It will also be helpful to earmark half of the aviation-induced revenues from the European Emissions Trading System (ETS) for the market ramp-up of SAF. The planned abolition of the German PtL quota is overdue. Not only is it in violation of European law, but it is also virtually impossible to fulfill. A common voice in Europe

In view of geopolitical upheavals, Europe cannot afford to have regulations that further weaken its own competitiveness and thereby undermine the objectives of the coalition agreement. Therefore, it is all the more important that the future German government speaks with one common voice in Brussels and resolutely represents its interests in favor of domestic value creation and employment. | |

| | | | EU aviation strategyWhen will Europe strengthen its sovereignty?High regulatory costs, massive competitive disadvantages and paralyzing bureaucracy: The EU is weakening itself. A strategic change of direction is more urgent than ever. | |

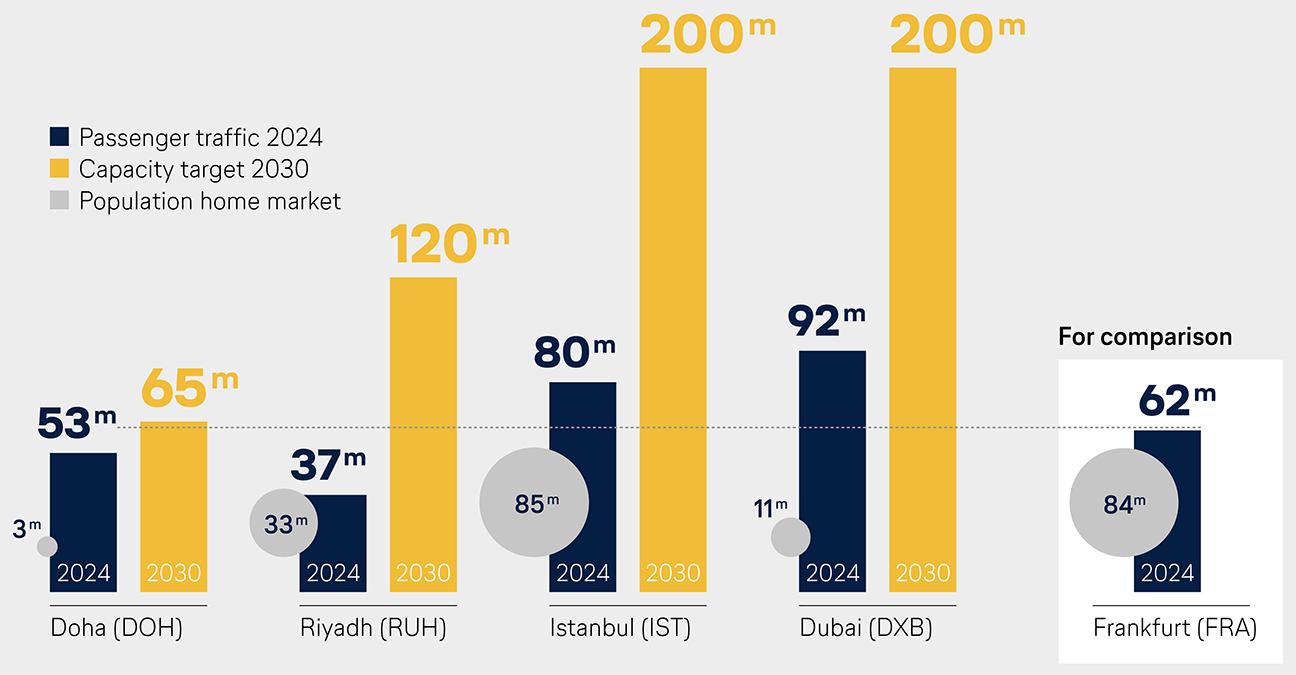

| | | | Expansion on the Persian Gulf and Bosporus until 2030

Airports in the Middle East are expanding disproportionately in relation to their home markets

| |

| | | | Competitive aviation is not an end in itself – it ensures that domestic economic and tourist regions remain connected and attractive, and it safeguards a wide range of jobs and value creation. An improvement in connectivity increases GDP per capita and creates additional jobs. Outside Europe, many countries provide targeted support for their own aviation sectors and invest heavily in infrastructure. Aviation is seen as a driver of growth and prosperity – briefly, as an industry of the future. In the EU, on the other hand, there is no coherent strategy. The Clean Industrial Deal and the Competitiveness Compass have so far done nothing to change the fact that EU policy is placing a one-sided burden on domestic airlines. This increases the risk that Europe will fall behind in global aviation – at the expense of connectivity and value creation. In times of geopolitical and trade policy conflicts, the EU Commission must act decisively. Numerous options for strengthening Europe‘s sovereignty in aviation are on the table: - Make EU climate protection competition-neutral: The Fit for 55 package and the quota for sustainable aviation fuels (SAF) unilaterally increase the cost of flying via EU hubs. As a result, traffic and emissions are shifted outside of Europe – without any benefit for the climate (carbon leakage). Therefore, the SAF quota should be financed through a climate protection levy based on travel destination or by the application of a CBAM-like mechanism for aviation.

- Align SAF targets with reality: The amount of SAF currently available on the global market is not sufficient to use large quantities in flight operations. This is particularly true for Power-to-Liquid (PtL) fuel. Furthermore, even bio-SAF is three to five times more expensive than conventional kerosene and PtL even up to ten times. A reality check is needed here. If there is no significant progress towards affordable and available sustainable fuels, the EU will have to readjust its targets.

- Promote SAF market ramp-up and make it more flexible: Since SAF is not available everywhere and the CO2 savings effect does not depend on the place of refueling, a book & claim system is needed to avoid logistical inefficiencies. Flexibility is an essential factor for a successful market ramp-up. In addition, coherent funding measures are needed as part of the announced Sustainable Transport Investment Plan (STIP).

- Reduce regulatory costs: Europe has become too expensive. The costs for European airlines to comply with EU legislation have tripled in the last ten years and will double again by 2030. The simplification envisaged by the EU in the omnibus procedure is not enough – red-tape must be cut even more decisively. In addition, EU legislation should be subjected to a comprehensive reality and competition check.

- Align air service agreements with EU interests: Given the serious allegations of corruption, the EU-Qatar aviation agreement must be suspended immediately. Future reforms and new aviation agreements must be based on clear criteria: competitive neutrality, reciprocity and effective sanctions.

In the view of new geopolitical realities, the European Commission must do everything it can to ensure Europe’s sovereignty and value creation. A new European aviation strategy is therefore more urgent than ever. | |

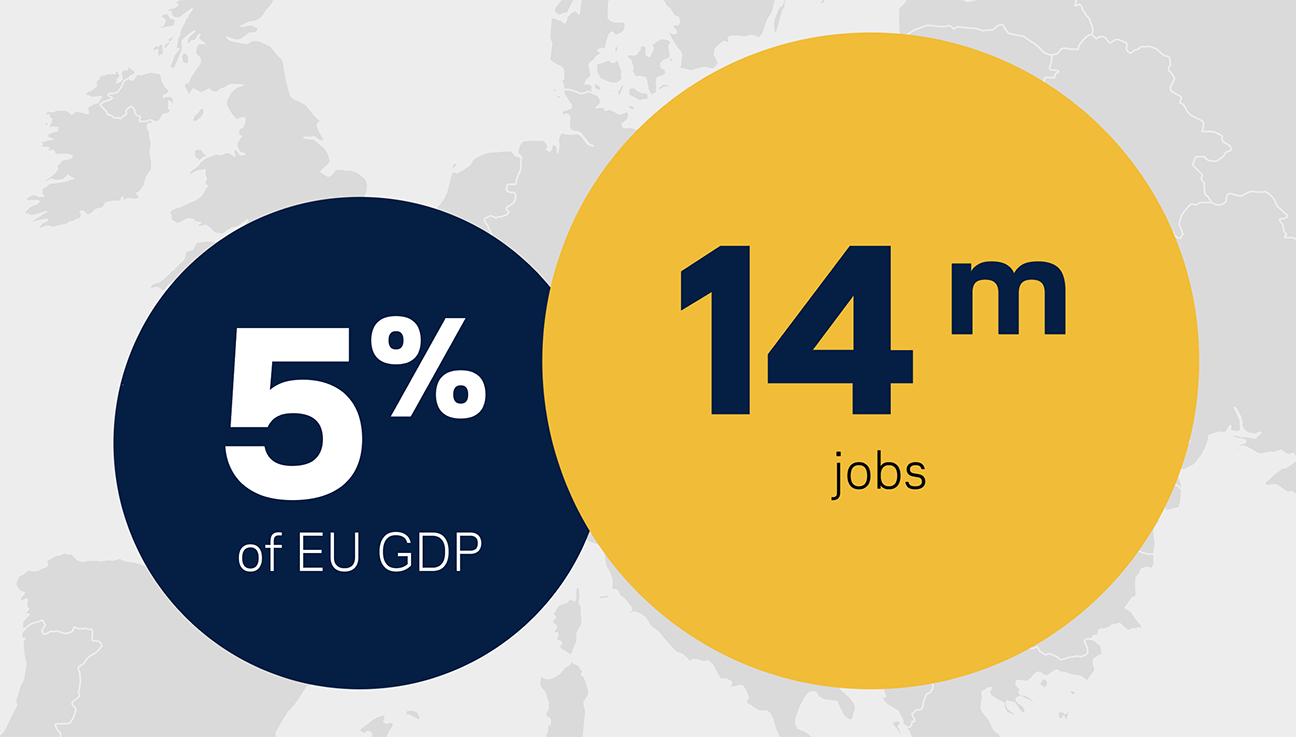

| | | | EU aviation is a key industry

Source: SEO Amsterdam Economics, October 2024 | |

| | | | PtL fuelsThe gap between vision and reality is wideningThe production of PtL kerosene is making little progress. The EU's policy toolbox is not sufficient to achieve the technological breakthrough. New ways of thinking are needed. | |

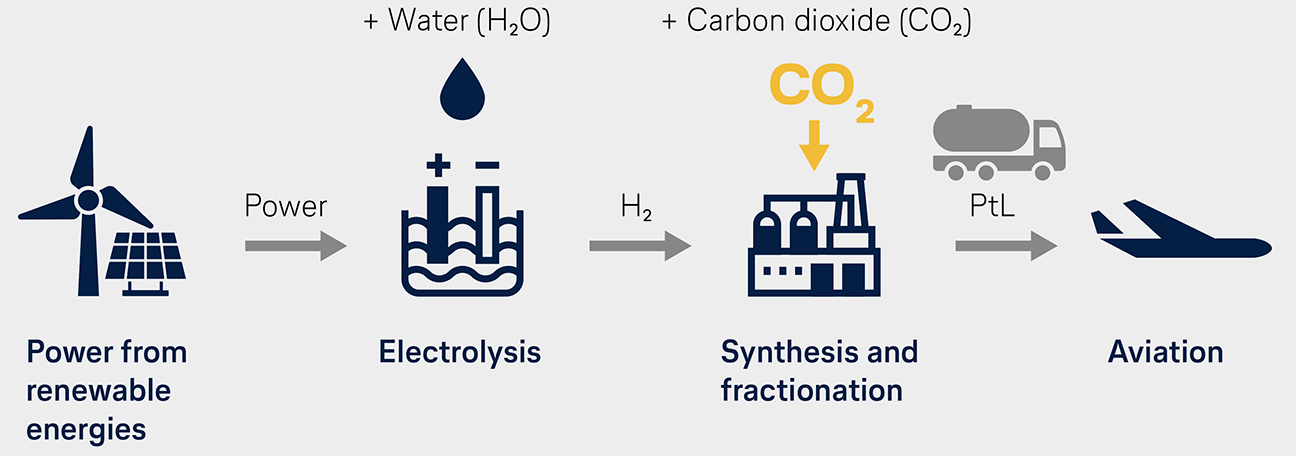

| | | | PtL production process

| |

| | | | Sustainable aviation fuels (SAF) are a key lever for decarbonizing aviation. Today, biogenic materials such as used cooking oils and animal fats account for about 90 percent of SAF production. For many years, the Power-to-Liquid (PtL) process has been seen as a promising technology. In this process, hydrogen and CO2 are converted into synthetic PtL kerosene (eFuels) using renewable energy. eFuels are almost climate-neutral and reduce dependence on fossil fuels. At least that is the vision. Market ramp-up is faltering

The Lufthansa Group is working with partners from science and industry around the globe to further develop SAF. The challenge is enormous – and reality shows that the production costs for small PtL volumes are still far too high for a broad market launch. Although the first demonstration plants are in operation in the United States and Germany, they only produce minimal quantities of PtL kerosene. Many production facilities are behind schedule. The lack of a business case is hindering the scale up. Political instruments ineffective

It is no longer possible to gloss over the economic reality. Political targets are increasingly receding into the distance. At the EU level, a PtL quota of 1.2 percent will apply from 2030, rising to 35 percent by 2050. The theory behind this is that a quota will generate sufficient demand to create an economic supply. It is now becoming clear that this rather simplistic mechanism is not working. Current projections show that without a change of course, the PtL supply will not be sufficient to meet the targets in aviation. New approaches needed

One thing is clear: the aviation industry cannot create a competitive market for sustainable fuels on its own. That is why the EU needs to take a new regulatory approach. How can PtL production be launched outside Europe? Can forces be unleashed across modes of transport? How can effective market-based incentives be created? What flexibility mechanisms are needed? It will hardly be economically feasible to implement PtL production in Germany – energy prices are too high, and renewable resources are too limited. The national PtL quota, which already applies from 2026, cannot change this either. Its abolition is only a first step. Half-hearted promises of support won't help either. From an airline perspective, it is clear that policymakers must finally come clean. The energy transition in aviation is a global mammoth task. It will not be enough to use a regulatory straitjacket to place the onus on the demand side alone. | |

| | | | eFuels gap

In 2030, eFuels supply will fall 45 percent short of targets. Prognosis: BCG, 2025 | |

| |

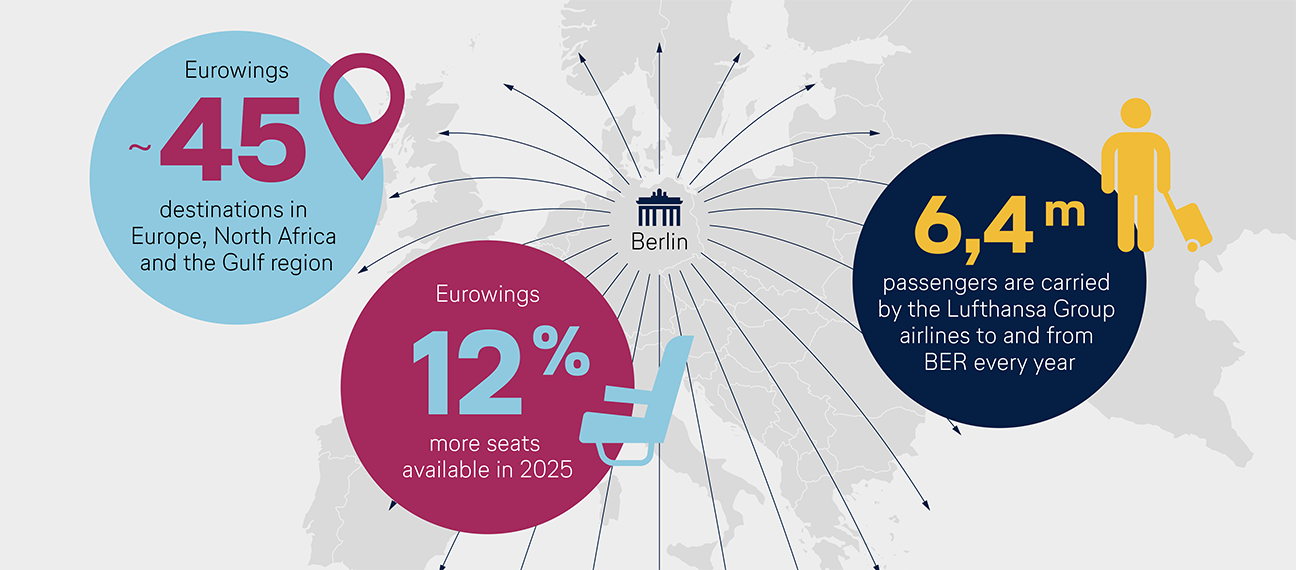

| | | | Connectivity at BERLufthansa Group as a strong partnerA Lufthansa Group aircraft takes off from BER every 15 minutes. Nevertheless, the connectivity of the capital city’s airport has been subject of criticism. High state location costs are a particular burden for the airport’s connections to European destinations.

Next year, Deutsche Lufthansa celebrates its 100th anniversary. The airline was founded in Berlin in 1926. A century later, the special relationship with Berlin continues to thrive: While other airlines are withdrawing due to high location costs, the Lufthansa Group is the market leader at BER with 30 percent of all connections and 500 weekly flights to 60 destinations. All of the Group‘s key business areas are also represented in the capital. More than 2,000 Lufthansa employees live and work in Berlin. Expansion of traffic rights ≠ more long-haul routes

However, the close partnership does not change the fact that additional long-haul connections from Berlin would hardly be profitable. Just recently, another attempt failed. An Asian carrier had to discontinue its direct connection between Berlin and Singapore. Once again it has become clear that, for historical reasons, BER is not a hub. Even the repeated calls for liberalized traffic rights, for example for airlines from the United Arab Emirates, do not help. This is because these carriers connect BER with their hubs in the Gulf – primarily for connecting flights to Asia or Africa. This has nothing to do with establishing additional long-haul routes for Berlin. BER suffers from location costs

The debate about more long-haul flights thus also misses the core problem of the capital city‘s airport. This is because it is primarily European direct connections that are developing sluggishly. Last year, the number of medium-haul flights on offer was only 82 percent of the pre-crisis level. The main reasons for this are the enormous state location costs at BER, which weaken local demand and lead to a decline in supply. This is precisely where politicians need to start if they really want to strengthen connectivity. | |

| | | | Lufthansa GroupStrong airlines united under one roofThe Lufthansa Group is one of the largest airline groups in the world and a leading player in Europe. Its airlines operate about 3,000 daily flights to more than 300 destinations in 100 countries. | |

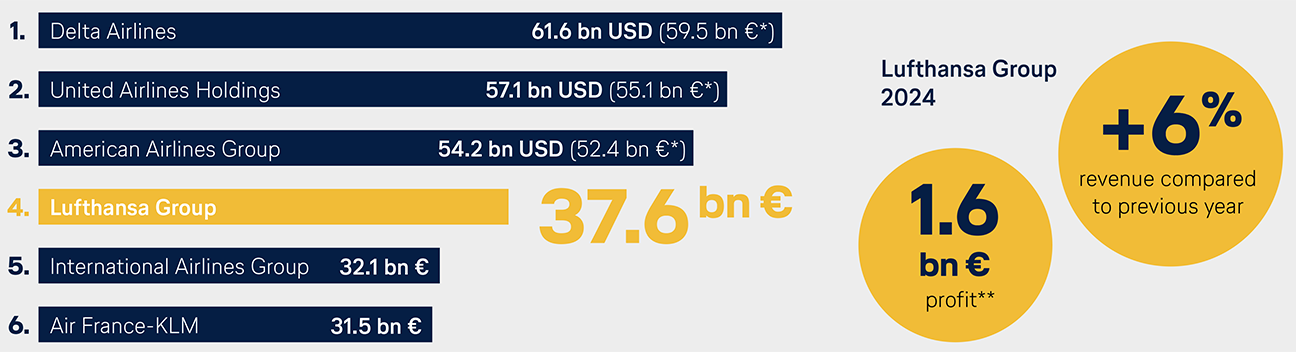

| | | | Top 6 airline groups by revenue 2024

With revenue of 37.6 billion euros, the Lufthansa Group is one of the world's four largest airline groups.

* According to ECB exchange rate as of Dec. 31, 2024, ** Adjusted EBIT; Sources: Company data | |

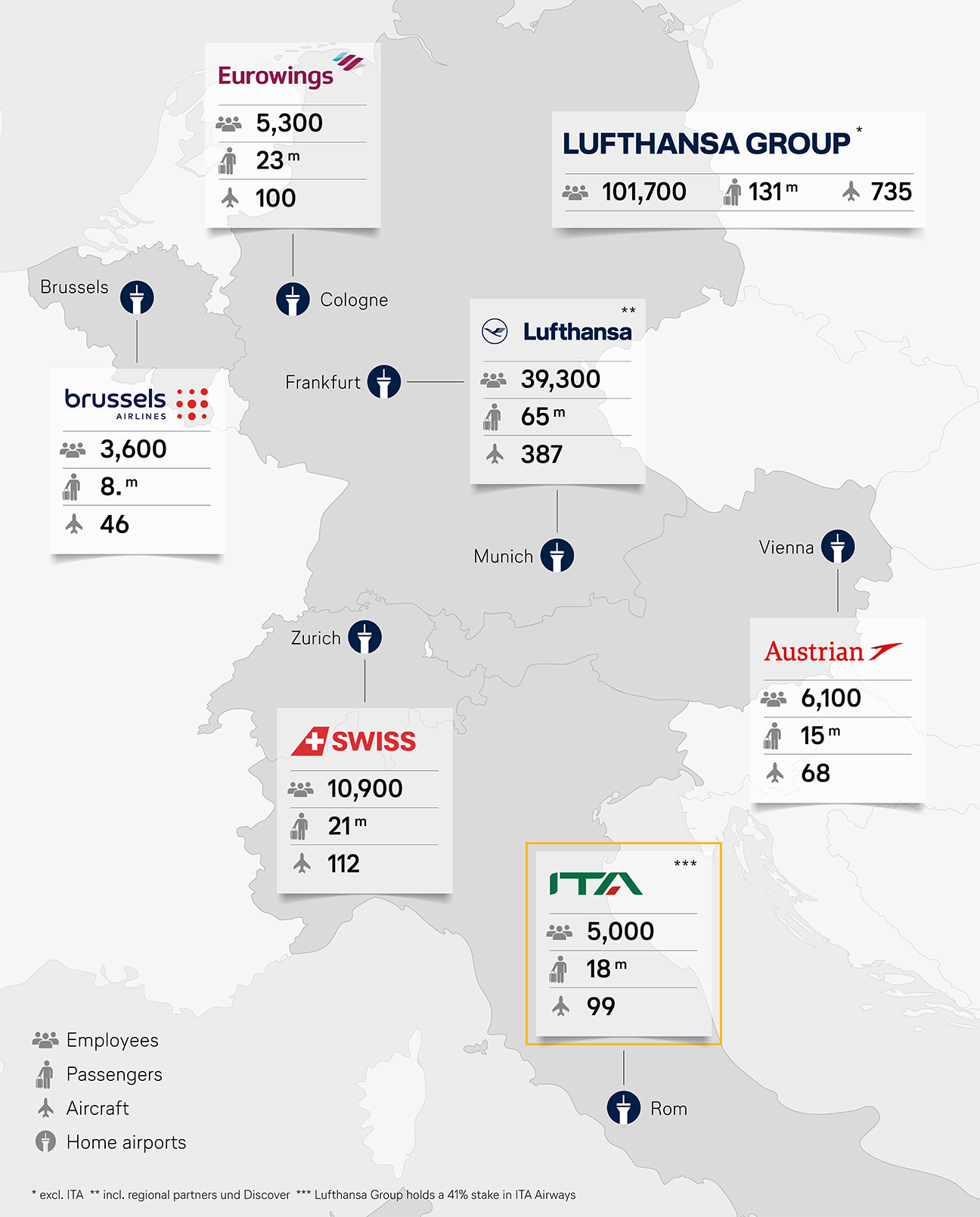

| | | | The passenger airlines form the core of the Lufthansa Group and benefit from important synergies. With a coordinated route network and six hubs – Frankfurt, Munich, Vienna, Zurich, Brussels and Rome – the Lufthansa Group is firmly rooted in the heart of Europe. The advantages: the Group can provide a comprehensive range of international flights, is flexible in its route planning and can leverage the strengths of the individual locations. The hubs play a key role here. Bundling traffic improves aircraft utilization, enabling the Group to efficiently serve a global route network and reduce emissions. Brand identity is highly valued

Each of the Group‘s airlines has a clear profile, that it uses to appeal to customers in its respective home market. Lufthansa and SWISS offer the highest connectivity, with many destinations served at high frequency, and premium standards with their on-board first class. Austrian Airlines and Brussels Airlines offer high-quality routes at their hubs in Vienna and Brussels, connecting their home countries to the global aviation network. Eurowings is the Lufthansa Group‘s value carrier. As Germany‘s largest leisure airline, it specializes in point-to-point traffic. Discover Airlines complements the Group‘s leisure travel offering in Frankfurt and Munich, Edelweiss at the Zurich hub. Air Dolomiti connects the main North Italian airports with Germany. ITA Airways, the youngest member of the Lufthansa Group family, connects Italy internationally via the Rome-Fiumicino hub. It also has a strong position at Milan airport, which has the second-largest catchment area in the European Union. Airline partnerships optimize worldwide connections

By cooperating with international airlines, the Lufthansa Group can offer additional long-haul connections worldwide and efficiently utilize capacity. One example is the joint venture with United Airlines and Air Canada. Together, the three airlines connect Europe and North America, offering their joint customers a unique network quality. In addition, the Lufthansa Group is striving to advance the consolidation of the airline industry. After all, size is crucial for an airline to be successful in international competition. | |

| | | | 2024: The Lufthansa Group's passenger airlines at a glance

The Passenger Airlines segment comprises the network airlines Lufthansa Airlines, SWISS, Austrian Airlines, Brussels Airlines and ITA Airways, which offer their customers a premium product and service, as well as Eurowings, which is positioned as a value carrier focusing exclusively on point-to-point traffic on short- and medium-haul routes.

| |

| | | | Lufthansa Cargo Special TransportFlying TigersWith 8.5 billion revenue tonne-kilometers sold in 2024, Lufthansa Cargo is one of the world‘s leading cargo airlines. In line with its mission of “Enabling Global Business”, Lufthansa Cargo connects trading partners and markets worldwide. Every day, goods worth over 100 million euros are exported from Germany. | |

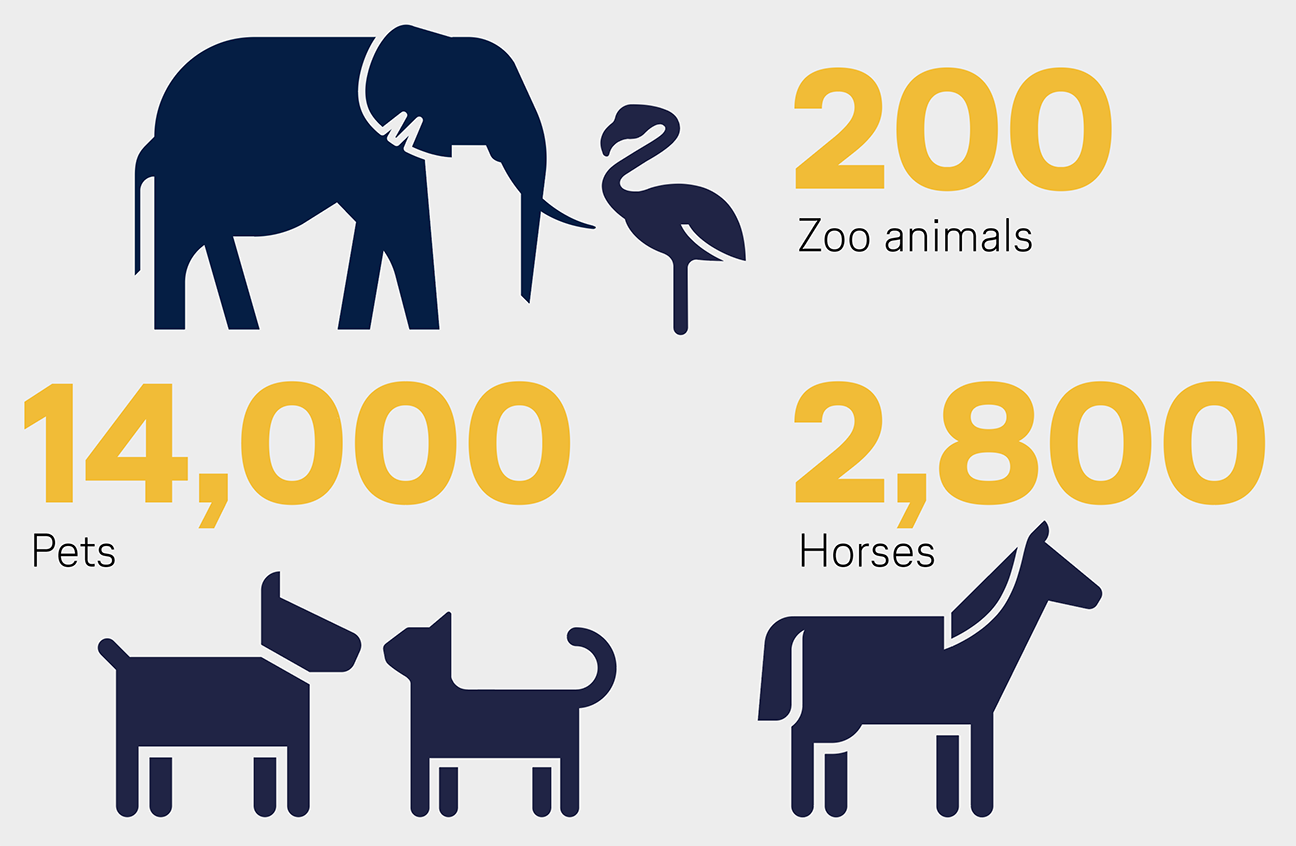

| | | | Travelling the world with animals

More than 80 million animals traveled with Lufthansa Cargo in 2024, including:

| |

| | | | The airfreight specialist transports an average of 2,500 tons of freight per day via its four cargo hubs in Frankfurt, Munich, Brussels and Vienna. Last year, this included more than 80 million animals, mostly ornamental fish, transported in compliance with the highest animal welfare standards. Among the most extraordinary animal passengers were two Siberian tigers, which were transported to Kazakhstan to be released into the wild. Two pygmy hippos and a rare red panda also traveled on a Lufthansa freighter. To provide the animals with the best possible care before departure, the company operates one of the world‘s largest and most modern animal stations, the “Frankfurt Animal Lounge”. Another area of expertise for Lufthansa Cargo is the transport of valuable works of art. In 2024, parts of the famous Berggruen collection and the hip-hop exhibition “The Culture” from Chicago reached their destination well protected on board the modern Boeing 777 fleet. | |

| | | | Lufthansa Express RailTicket also valid for local public transportWhen the flight begins on the train: Lufthansa Express Rail offers a convenient way to get to Frankfurt Airport. The Lufthansa boarding pass is now also valid for bus, tram, subway and S-Bahn travel to and from the Express Rail station. | |

| | | | With Lufthansa Express Rail, customers can purchase a combined rail and air ticket in a single step – and travel by ICE from 28 German cities to Frankfurt Airport. Since March, the offer has included a practical upgrade: The Deutsche Bahn (DB) City Ticket is included in the Lufthansa Express Rail booking. This allows travelers to use public transportation in 26 German cities before and after their flight. The Lufthansa boarding pass conveniently covers the entire route. Demand for Lufthansa Express Rail has been steadily increasing. In 2024 alone, around 500,000 passengers used the service to travel to and from Frankfurt Airport. This corresponds to around 1,000 fully loaded Airbus A380-800s. | |

| | | | LUFTHANSA GROUPYour Contacts PDF PDF

Andreas Bartels

Head of Corporate

Communications

Lufthansa Group  +49 69 696-3659 +49 69 696-3659

andreas.bartels@dlh.de andreas.bartels@dlh.de

|

Dr. Kay Lindemann

Head of Corporate

International Relations and

Government Affairs

Lufthansa Group  +49 30 8875-3030 +49 30 8875-3030

kay.lindemann@dlh.de kay.lindemann@dlh.de

|

Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group  +49 69 696-36867 +49 69 696-36867

martin.leutke@dlh.de martin.leutke@dlh.de

|

Jan Körner

Head of Government Affairs

Germany

Lufthansa Group  +49 30 8875-3212 +49 30 8875-3212

jan.koerner@dlh.de jan.koerner@dlh.de

|

Sandra Courant

Head of Political Communication

and Media Relations Berlin

Lufthansa Group  +49 30 8875-3300 +49 30 8875-3300

sandra.courant@dlh.de sandra.courant@dlh.de

|

Ruben Schuster

Head of EU Liaison Office

Lufthansa Group  +32 492 228141 +32 492 228141

ruben.schuster@dlh.de ruben.schuster@dlh.de

|

| |

| | | | Published by:

Deutsche Lufthansa AG

FRA CI,

Lufthansa Aviation Center

Airportring, D-60546 Frankfurt Andreas Bartels

Head of Corporate

Communications

Lufthansa Group Dr. Kay Lindemann

Head of Corporate International

Relations and Government Affairs

Lufthansa Group Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group | Editor in Chief:

Marie-Charlotte Merscher, Dr. Christoph Muhle Editorial Staff:

Henrietta Dörries, Nicolas Dünkelsbühler, Anton Heinecke, Thrasivoulos Malliaras, Philipp Struve Press date:

10 April 2025 Agency Partners:

Köster Kommunikation |

| |

|