| | | | Dear readers,

For almost 20 years, it has been the subject of debate and legal disputes – the EU Air Passenger Rights Regulation. With more than 200 cases before the European Court of Justice (ECJ), this regulation is one of the most hotly contested pieces of legislation. Every year, thousands of such cases overburden the courts. All of this clearly shows: a reform that brings legal clarity for both passengers and airlines alike is urgently needed.

Even today, the regulations in aviation are exceptionally consumer-friendly compared to other industries. In some cases, the compensation that passengers may receive for delays even exceeds the original ticket price. The long-overdue revision of the regulation must continue to appropriately reflect the interests of passengers. At the same time, it must also consider the operational realities faced by airlines – particularly to safeguard the competitiveness of EU carriers against their non-European competitors.

Germany too must strengthen the competitiveness of its aviation sector. Nowhere else in Europe is flying as expensive as in Germany, due to high state-imposed taxes and fees. The federal government has pledged relief in its coalition agreement. This must now be turned into concrete action. Germany’s aviation tax should be reduced, as should the costs for air traffic control and aviation security. Aviation is a key driver of the German economy. This value and a reliable connection to the world are indispensable for Germany as an export nation.

As part of the Lufthansa Group’s innovation program, Eurowings is the first German airline to offer a premium business class on medium-haul routes. Passengers from Berlin and Brandenburg will be the first to enjoy the new comfort, as the new ‘Premium BIZ Seat’ will be introduced on the Berlin–Dubai route in autumn. With this, Lufthansa Group is once again investing in its Berlin offering,strengthening its position as the market leader at BER.

Enjoy the reading! Andreas Bartels

Head of Corporate

Communications

Lufthansa Group | Dr. Kay Lindemann

Head of Corporate

International Relations and

Government Affairs

Lufthansa Group |

| |

| | | | EU air passenger rightsReconciling consumer protection and operational realityIn June, the EU transport ministers agreed on a common position on the EU Air Passenger Rights Regulation (EC No 261/2004). It is now up to the Parliament to shape a framework that delivers practical, balanced solutions – rather than driving up ticket prices across the board and once again imposing new unilateral burdens on EU airlines. | |

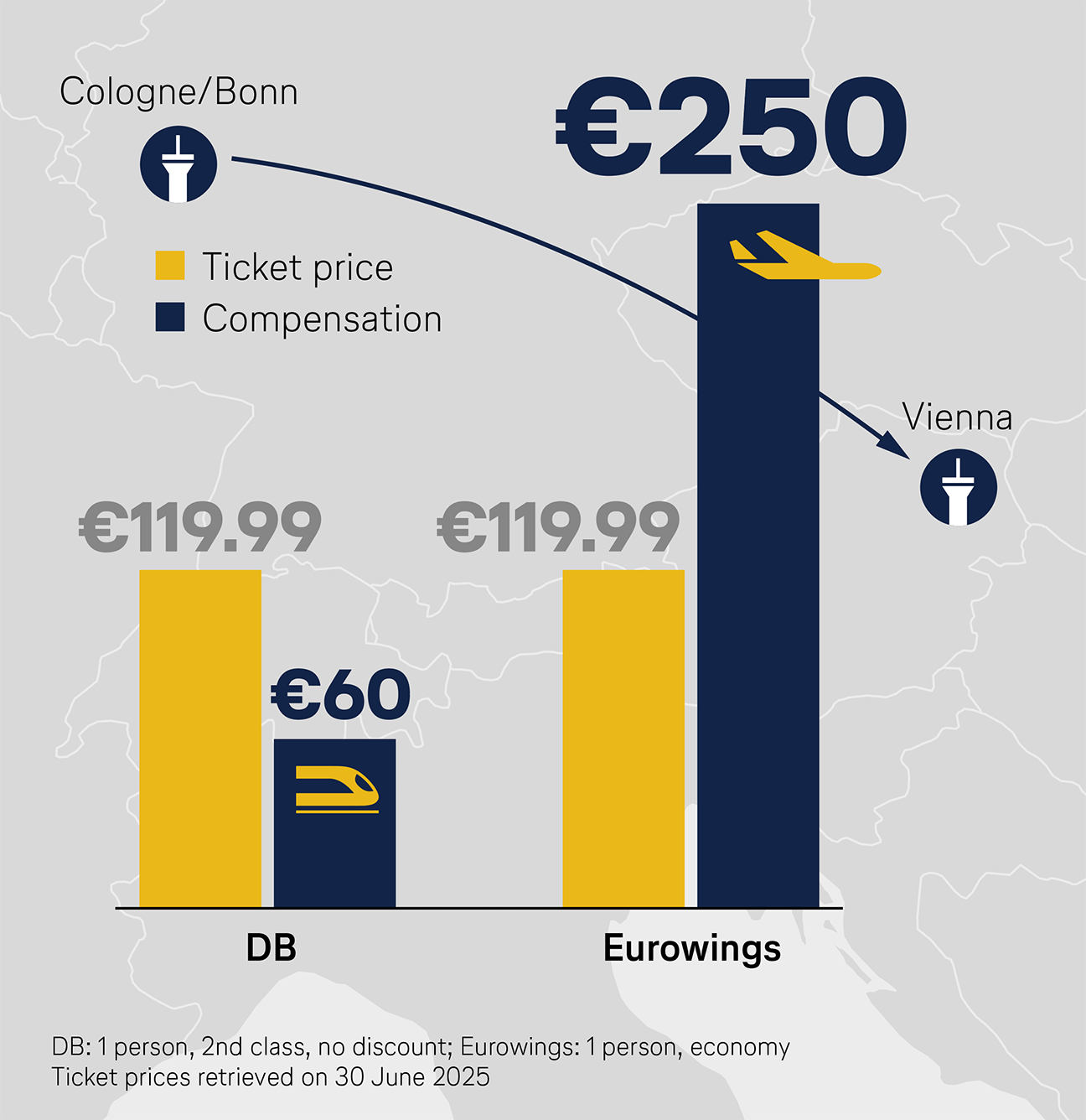

| | | | Compensation in aviation can exceed ticket prices

Example: Cologne-Vienna on 10 July with a three-hour delay

| |

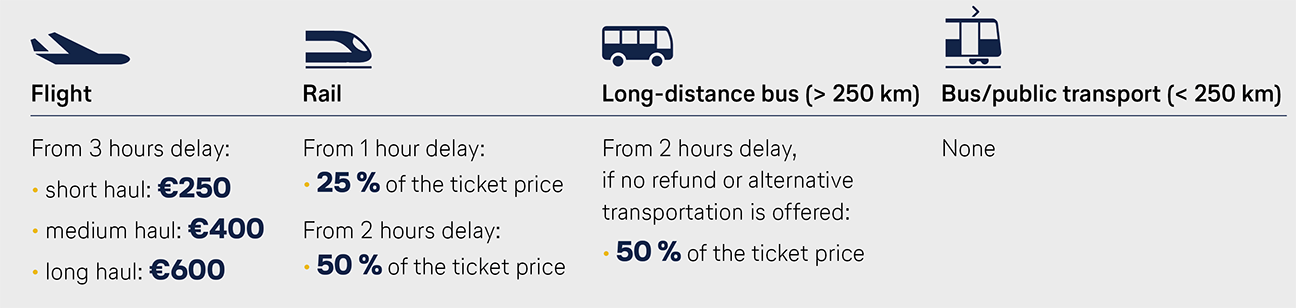

| | | | European aviation is already a global leader in consumer protection. Nowhere else do customers have comparable rights: comprehensive care services, state-provided arbitration mechanisms and enforcement of claims, and, most notably, flat-rate compensation for delays, which can significantly exceed the ticket price. For example, between October 2023 and September 2024, a European flight from Germany cost an average of 202 euros, and from Italy only 129 euros. Yet, passengers arriving three hours late could claim up to 250 euros on short-haul and 400 euros on medium-haul routes, nearly double the average ticket price. Money versus fast transport

This situation may seem appropriate if consumer protection is reduced to the monetization of delays. That is, of course, supported by the vocal claims industry (known as claim farms), that enforces passengers’ claims in return for hefty commissions.

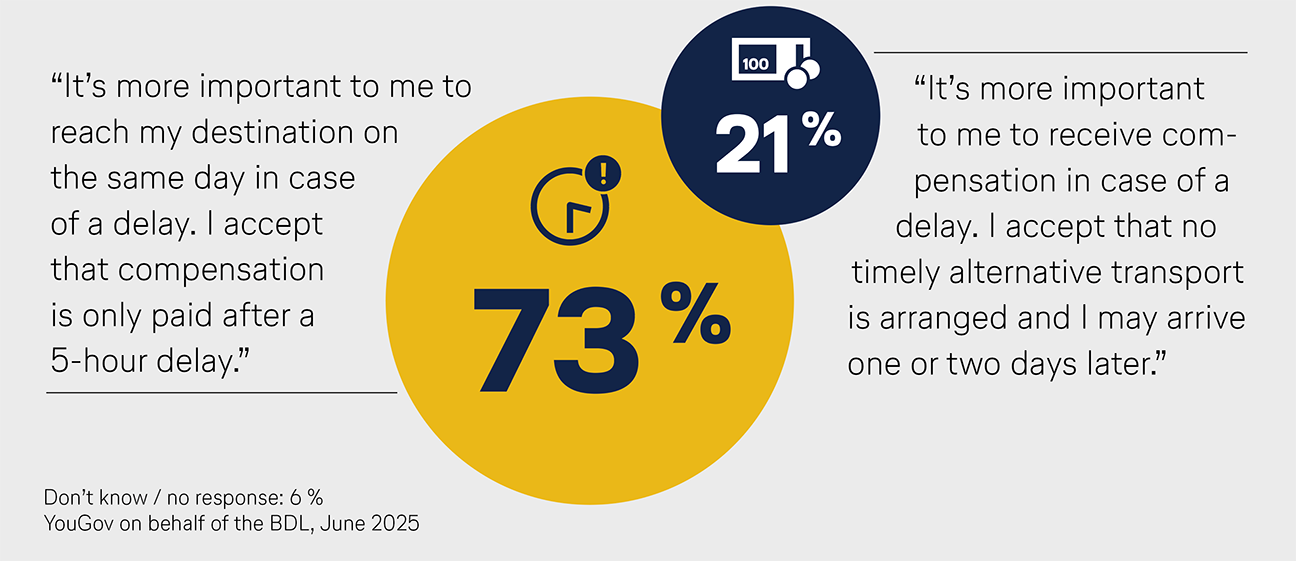

Instead, effective passenger protection in aviation should prioritize the main interest of travelers to reach their destinations as quickly as possible. Ironically, the current framework often undermines that goal: airlines must pay substantial compensation for delays as short as three hours – an interval in which repairs, aircraft or crew replacements are rarely feasible. As a result, canceling the flight altogether can become the only financially viable option, particularly when rescheduling is not feasible due to route frequency or aircraft availability. For passengers, however, this is the worst-case scenario – especially on less frequented routes where last minute rebooking is often not possible.

A more practical approach would be to raise the compensation thresholds to at least five hours for short- and medium-haul flights and nine hours for long-haul flights. This would give airlines both the flexibility and the incentive to find solutions that are in the best interests of passengers instead of cancelling the flight in question. The EU Commission already proposed such a revision as early as in 2013.

ECJ drives up ticket costs

Over recent years, case law has increasingly taken the place of legislation. Decisions by the European Court of Justice (ECJ) have systematically driven up costs for airlines and thus ticket prices. In 2024 alone, the Lufthansa Group had to spend over 500 million euros in compensation under the Air Passenger Rights Regulation. A large share of this amount resulted from a key ECJ interpretation: unlike Germany’s Federal Court of Justice in its previous rulings, the ECJ ruled that airlines are liable for compensation even when delays are caused by strikes among their own staff. | |

| | | | Compensation comparison: EU air travel leads the way in consumer protection

| |

| | | | ‘Extraordinary Circumstances’ must be clearly defined

Whether a claim for compensation exists depends crucially on whether ‘extraordinary circumstances’ – i.e., situations beyond the normal scope of an airline’s activities – exist. These include, for example, severe weather, airspace restrictions or closures, or medical emergencies. Yet the current Regulation provides no clear legal definition, leaving both passengers and airlines in a state of legal uncertainty. Clear, binding criteria are urgently needed to ensure transparency and legal certainty. A concrete, unambiguous and legally binding provision is urgently needed.

Further reform is needed to address the current practice of holding airlines liable on the grounds that they ‘should have taken reasonable precautions.’ In many cases, this is unrealistic. If an aircraft or a crew member is unavailable at short notice, it is virtually impossible to provide adequate replacement quickly, especially on long-haul flights or at remote airports. Fully complying with the ECJ requirement, would mean to keep backup aircraft and personnel at every destination – an operational and economic impossibility.

Recognize strikes as extraordinary circumstances

Strikes by an airline’s own staff should also qualify as extraordinary circumstances in future. After all, decisions to strike are made solely by the trade unions and not the airline. The Federal Court of Justice clarified this in 2012: ‘The strike call […] affects the airline from outside and is not part of the normal exercise of its business activities.’ Moreover, mandatory compensation payments during strikes – often reaching millions – place airlines under intense pressure to concede to union demands, thereby undermining collective bargaining autonomy and exacerbating competitive disadvantages.

EU consumer protection distorts competition

Unlike EU carriers, many non-European airlines operate out of countries where the right to strike does not even exist. Moreover, the Regulation applies only in limited cases to non-EU carriers flying into the EU – creating an uneven playing field. A meaningful reform must also address these imbalances to ensure fair competition.

Now is the time to get the framework right

The Air Passenger Rights Regulation was a milestone for consumer protection in Europe. But after almost 20 years of expansion by the European Court of Justice, it needs fundamental reform that does justice to operational and economic realities. The aim must be to make it fit for the future while at the same time ensuring the competitiveness of European airlines. | |

| | | | YouGov survey: Fast arrival more important than compensation

| |

| | | | Aviation in GermanyRelief urgently neededThe German government has announced relief measures for the aviation sector in its coalition agreement. What matters now is a swift implementation. | |

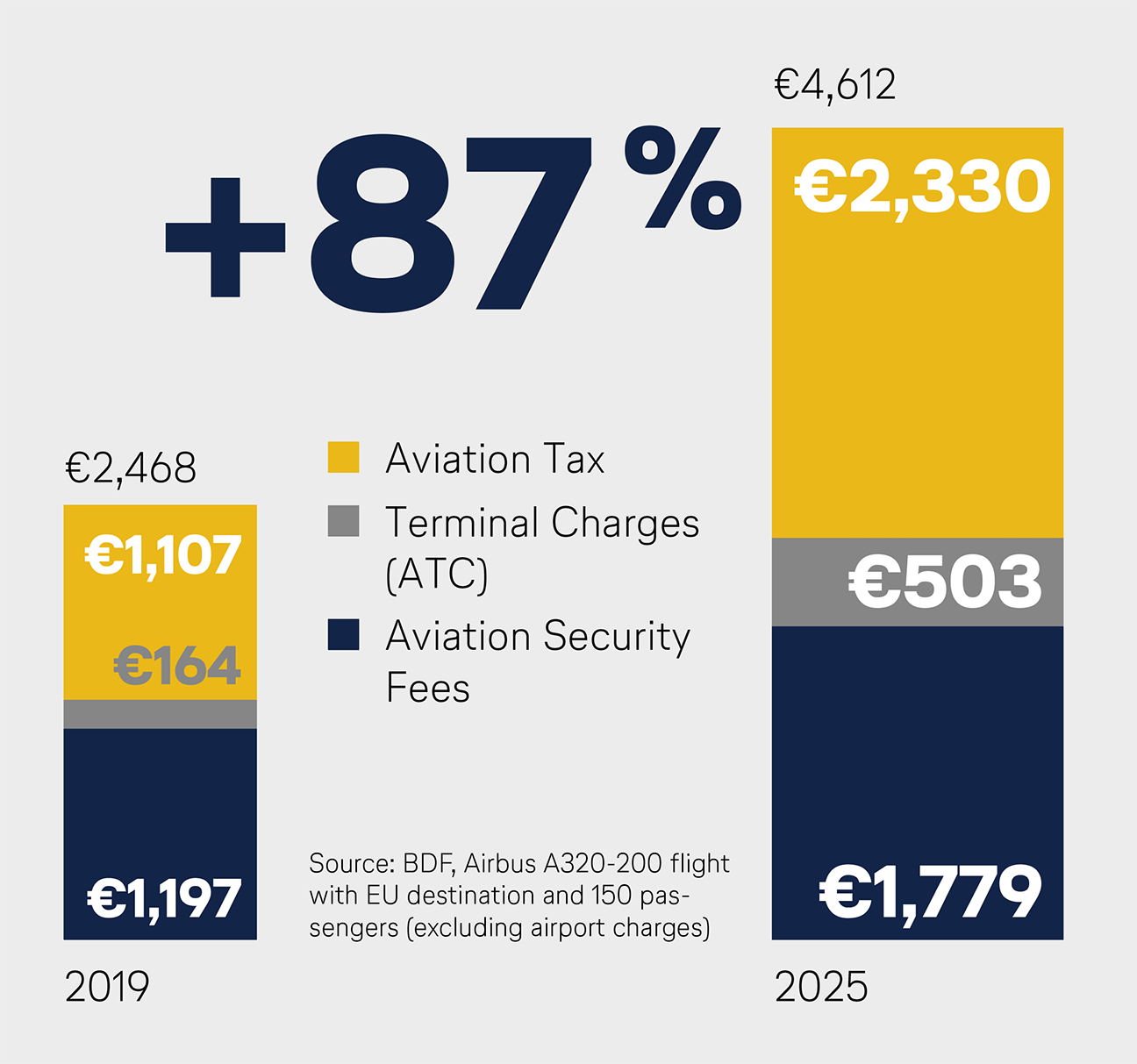

| | | | Example flight from Frankfurt to an EU destination

Government location costs have risen enormously since 2019. When an A320 flight takes off from Frankfurt to a European destination, it now incurs more than €4,600 in taxes and fees – an increase of almost 90 per cent compared to 2019. | |

| | | | No other European country imposes a greater tax burden on flights than Germany. Since 2019, state-imposed location costs have doubled. At some airports – such as Düsseldorf, Cologne, Stuttgart, Hamburg and Leipzig – the cost increase has been even more pronounced. As a result, airlines are forced to cut domestic routes and increasingly relocate aircraft abroad. Even economically strong locations are losing international connectivity. Seat capacity in Germany is stagnating at around 90 per cent compared to 2019, while air traffic in the rest of Europe has long surpassed pre-COVID volumes. Reduce aviation tax

A key cost driver is the aviation tax, which has been levied on all flights from German airports since 2011. Along with the tax, a reduction mechanism was introduced that reduced the tax when EU ETS costs increased, for example due to rising CO2 certificate prices. However, this mechanism was abolished in May 2024, while the aviation tax itself was significantly increased at the same time. As a result, the annual revenue from this tax has thus more than doubled to over two billion euros.

Compared to other EU countries, Germany stands alone: only six other member states impose a comparable levy – and none at this level. Urgent action is needed here. That is why the reversal of the latest increase, as announced in the coalition agreement, is the right move. However, this can only be a first step. In the longer term, the tax must be reduced further, and the reduction mechanism reinstated. Federal funding for air traffic control and aviation security

To get aviation in Germany back on track, it is also essential to reduce the costs of air traffic control and aviation security. Since the start of this year, overflight charges have risen by a quarter, and by as much as 40 per cent for arrivals and departures – without any improvement in quality. On the contrary: a shortage of air traffic controllers is regularly leading to delays.

German air traffic control must provide personnel and infrastructure for monitoring the airspace around the clock. Unlike rail or waterways, the basic costs are borne entirely by the users, that is the airlines. In future, the federal government should assume a greater share of these costs. The special infrastructure fund creates the necessary fiscal leeway.

The same applies to the funding of aviation security. As part of anti-terrorism and public safety efforts, aviation security is a sovereign responsibility. Yet so far, the cost has been passed on to passengers. Here, too, greater commitment is needed from the federal government to achieve a fair distribution of the burden in future.

It is now crucial that this is anchored in the 2026 budget plans. Swift and determined political action is needed to secure long-term value creation, employment and connectivity in Germany’s aviation sector. | |

| | | | Coalition agreement 2025:

“We want to reduce aviation-specific taxes, levies, and charges and reverse the recent increase in aviation tax.” | |

| | | | Germany’s aviation industrySecuring value creationAviation is a key driver of the German economy. It ensures mobility for people, markets and businesses, thereby creating jobs and generating value throughout the country. | |

| | | | The aviation sector in Germany employs around 1.5 million people and generates more than 130 billion euros annually – more than three per cent of the country’s GDP. Airports, airlines and service providers are powerful enablers for an export-oriented economy that relies on global connectivity.

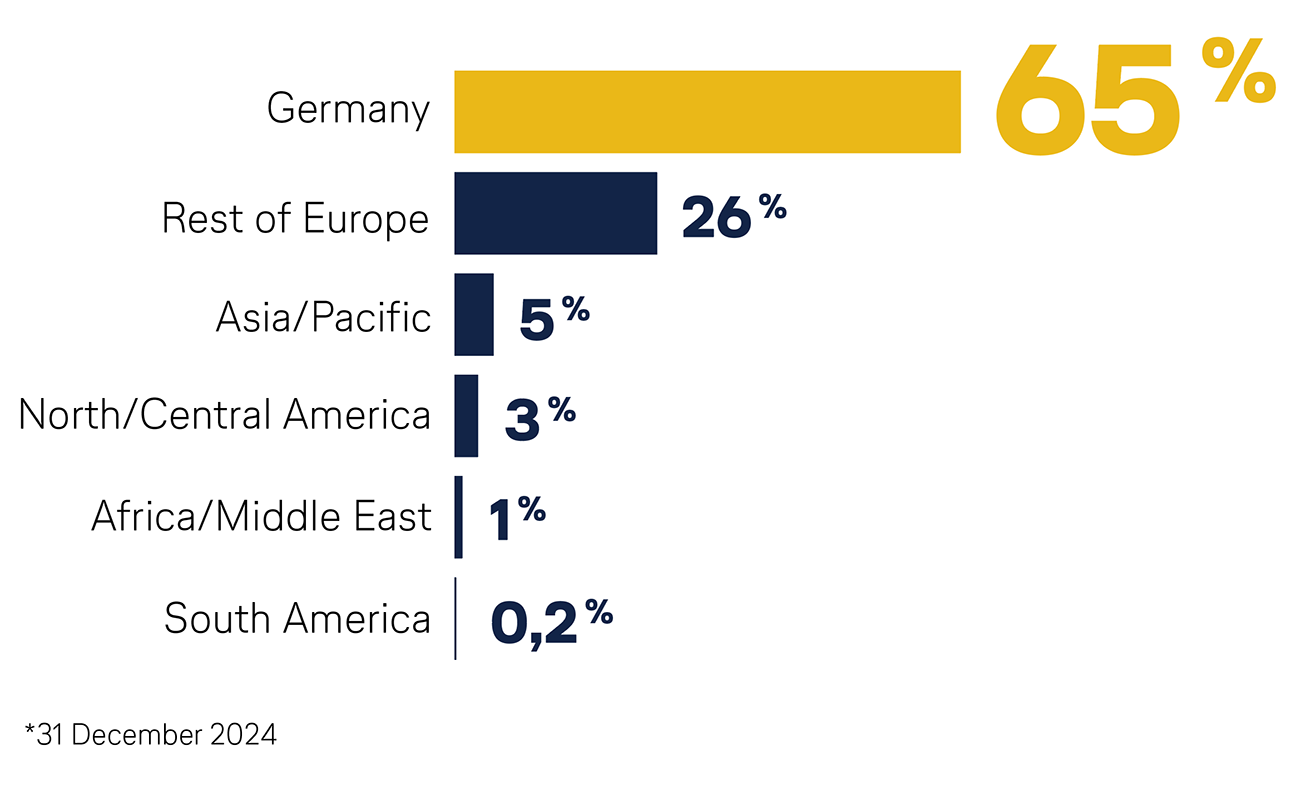

The Lufthansa Group plays a vital role in maintaining Germany’s position as a global aviation leader. Around 65 per cent of the Group’s more than 100,000 employees are based in Germany. This year alone, the company is hiring around 10,000 new employees across the Group. Over the next five years, the Lufthansa Group will invest in 180 new aircraft with a list price of over 30 billion euros for its German flight operations – along with 600 million euros in a new air freight center, and more than 300 million euros in expanding Lufthansa Technik in Hamburg. This is a clear commitment to the German home market. However, international competitive conditions have increasingly shifted to the detriment of German aviation. Because location costs are extremely high here, domestic routes are becoming unprofitable. As a result, even economically strong German regions are losing connectivity. More and more connections are shifting to hubs outside Germany and Europe. For the first time this summer, the Lufthansa Group stationed more aircraft at international hubs than in Frankfurt and Munich. Three out of four tickets are now being sold outside Germany.

Now, decisive policy action is needed in Berlin and Brussels to establish competitive conditions for the aviation sector. Independent global connectivity is essential for Germany. If this succeeds, it will lay a crucial foundation for renewed economic growth. | |

| | | | 102,500 Lufthansa Group employees by region*

| |

| | | | Premium at BEREurowings introduces new Business Class seatsMore comfort, more quality, more destinations – the Lufthansa Group is underlining its commitment to Germany’s capital region. | |

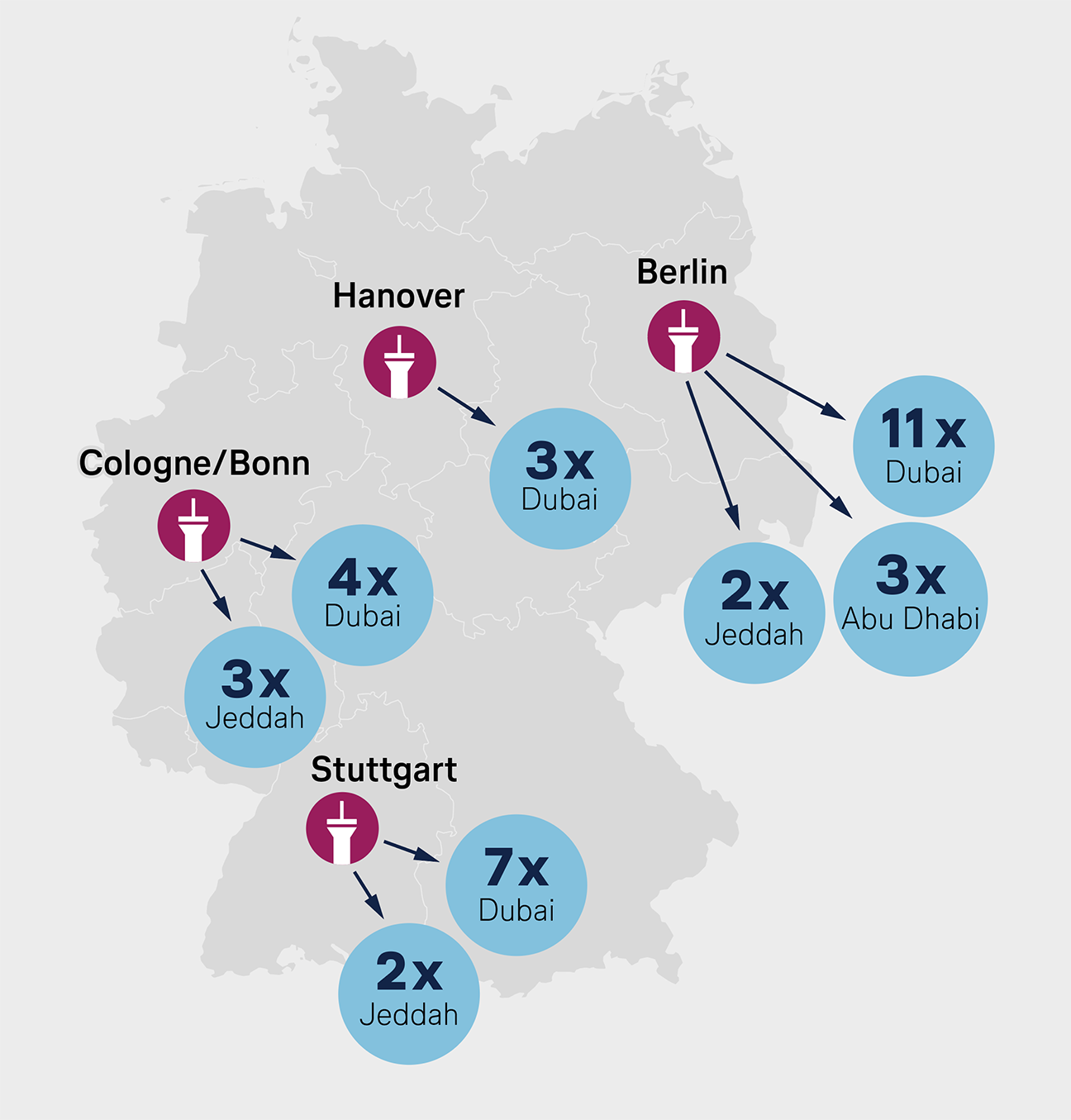

| | | | Weekly Eurowings flights to the Middle East

Winter 2025/26

| |

| | | | From autumn 2025, Eurowings will be offering a new comfort experience on the Berlin–Dubai route: As the first German airline, this Lufthansa subsidiary will equip medium-haul aircraft with new Business Class seats and integrate the ‘Premium BIZ Seat’ on its Airbus A320neo. The 2x2 seat configuration with adjustable backrests, ergonomic design and generous cushioning brings long-haul comfort to medium-haul flights, with increased privacy included.

The Premium BIZ Seat is part of the Lufthansa Group’s broader innovation program. The experience gained in the Berlin–Dubai pilot project will be incorporated into the Group‘s future cabin strategy. The aim is to set new standards in product quality and customer experience. The offer can be booked from August 2025.

With this step, the Lufthansa Group is introducing an attractive premium product to the capital – for business travelers and quality-conscious holidaymakers alike. The Group is thus underlining its market leadership at BER.

Route expansion towards the Middle East

Alongside the product launch, Eurowings is significantly expanding its medium-haul offering at BER. From winter 2025/26, Abu Dhabi will be added to the schedule and the frequency to Dubai will increase to eleven flights per week. Jeddah will also remain part of the flight schedule. This means that Eurowings will fly twice daily from BER to the United Arab Emirates in the coming winter season, connecting Germany’s capital region with three attractive destinations in the Middle East.

Fair competition is crucial

This commitment is also an industry policy statement: while airlines from the Gulf region benefit from extensive government subsidies, the Lufthansa Group is investing specifically in quality and innovation under challenging conditions in Germany.

It is – and remains – the responsibility of policymakers to create fair competition and to strengthen domestic carriers on the global stage. With direct flights to the Arab world and close links to destinations around the world via Frankfurt and Munich, among other cities, the Lufthansa Group makes an important contribution to the connectivity of Berlin and Brandenburg. This secures international connectivity for Germany’s capital region, especially to the Persian Gulf area – even without the need for additional traffic rights for non-EU carriers. | |

| | | | Airlines from the UAE can already land in Berlin

Like all airlines flying to Germany, carriers from the UAE are also allowed to fly to Berlin. In terms of traffic rights, they are entitled to choose from four landing points in Germany. Emirates and Etihad have opted for Munich, Frankfurt, Hamburg, and Düsseldorf airports. So far, they have declined to shift operations in favor of the Germany capital. | |

| | | | AI in aviationSmart solutions for complex challengesArtificial intelligence (AI) can be used to identify patterns and correlations in large amounts of data that often remain hidden from human analysis. A growing number of AI applications are helping to make aviation more sustainable and efficient. The following three examples show how the Lufthansa Group is using AI to optimize operational processes and save resources. | |

| | | | Well prepared: weather forecasts that prevent surprises

At the hubs in Frankfurt and Munich, Lufthansa is working with weather technology company Tomorrow.io. The US-based company uses AI to combine satellite data with weather data from the Earth’s surface in real time for its weather forecasts. These precise and locally differentiated forecasts allow for weather developments to be better assessed and processes on the ground and in the air to be better controlled.

These up-to-date weather forecasts allow flight routes to be adjusted proactively, reducing the need for diversions and lowering fuel consumption, for example. They also help ground operations to respond earlier to challenging weather conditions, enabling preventive planning. The result: fewer flight irregularities and a smoother travel experience for passengers. Precisely calculated: experience optimizes meal selection

Was the meal fully consumed, partially eaten, or left untouched? The AI-powered ‘Tray Tracker’ measures food returns from on board directly at the dishwashing line, linking this information with factors such as flight route, travel class and catering concept. Based on this, the selection and portion sizes of meals can be tailored to passenger demand. This enables more accurate loading, avoiding additional emissions and unnecessary food waste. The ‘Tray Tracker’ is already in use in Frankfurt and Munich. In future, the technology will also be deployed at other locations.

Closely monitored: maintenance before problems arise

Aircraft collect extensive datasets with hundreds of sensors on every flight. Lufthansa Technik uses this data via its digital platform ‘Aviatar’ to support airlines in managing their fleet operations. Using predictive maintenance, data from over 4,000 aircraft help to identify potential failures in individual components before they occur. AI-powered analysis enables maintenance actions to be planned in advance – transforming unplanned repairs into scheduled processes and significantly reducing ground time.

Aviation is a tightly scheduled, global system that is made almost infinitely complex by countless influencing factors. AI-supported analysis helps identify patterns in the large amounts of data generated by aviation. This enables increasingly accurate forecasts – a key factor in making aviation more efficient, sustainable, and reliable. | |

| | | | Sustainability explainedFuture technologies in aviationIndustry and research are working on solutions for the future of flying. The aim is to make aviation more resource-efficient and environmentally friendly. | |

| | | | Flying has become significantly more efficient and quieter in recent decades. The greatest progress has come from advances in engine technology. At the same time, aircraft design has been continuously improved. The latest models, such as the Boeing Dreamliner and the Airbus A350, also feature optimized aerodynamics and lighter materials. Compared to their predecessors, they emit up to 30 percent less CO2.

The Lufthansa Group is also leveraging every available measure to make flying more climate-friendly. It invests billions annually in new aircraft, actively supports the scale-up of sustainable aviation fuel (SAF) markets, and continuously improves operational efficiency. In addition, the Group is involved in various initiatives to pave the way for forward-looking technologies and propulsion systems.

To see which innovations will shape the future of flying – and what role energy sources such as SAF, hydrogen and batteries will play – watch our video. | |

| | | | LUFTHANSA GROUPYour Contacts PDF PDF

Andreas Bartels

Head of Corporate

Communications

Lufthansa Group  +49 69 696-3659 +49 69 696-3659

andreas.bartels@dlh.de andreas.bartels@dlh.de

|

Dr. Kay Lindemann

Head of Corporate International

Relations and Government Affairs

Lufthansa Group  +49 30 8875-3030 +49 30 8875-3030

kay.lindemann@dlh.de kay.lindemann@dlh.de

|

Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group  +49 69 696-36867 +49 69 696-36867

martin.leutke@dlh.de martin.leutke@dlh.de

|

Jan Körner

Head of Government

Affairs Germany

Lufthansa Group  +49 30 8875-3212 +49 30 8875-3212

jan.koerner@dlh.de jan.koerner@dlh.de

|

Sandra Courant

Head of Political Communication

and Media Relations Berlin

Lufthansa Group  +49 30 8875-3300 +49 30 8875-3300

sandra.courant@dlh.de sandra.courant@dlh.de

|

Ruben Schuster

Head of EU Liaison Office

Lufthansa Group

+32 492 228141 +32 492 228141

ruben.schuster@dlh.de ruben.schuster@dlh.de

|

| |

| | | | Published by:

Andreas Bartels

Head of Corporate Communications

Lufthansa Group Dr. Kay Lindemann

Head of Corporate International

Relations and Government Affairs

Lufthansa Group Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group

Deutsche Lufthansa AG

FRA CI, Lufthansa Aviation Center

Airportring, D-60546 Frankfurt | Editor in Chief:

Sandra Courant Editorial Staff:

Henrietta Dörries, Steffen von Eicke, Thrasivoulos Malliaras, Marie-Charlotte Merscher, Dr. Christoph Muhle, Christian Schäfer, Yannick Tubes Press date:

10 July 2025 Agency Partner:

Köster Kommunikation |

| |

|