XXL growth plans outside Europe

Aviation locations, especially in the Middle East, are consistently focusing on expansion. Three examples:

- Istanbul: In 2024, the airport recorded around 80 million travelers. Capacity is to be expanded to 200 million by 2028.

- Dubai: The world's largest airport terminal is to be built at Al Maktoum International Airport, also known as Dubai World Central. The investment costs amount to around 33 billion euros.

- Saudi-Arabia: The government wants to more than triple passenger traffic to 330 million travelers by 2030 compared to 2023. The planned investment costs amount to around 100 billion US dollars.

The airlines on the Bosporus and Persian Gulf are not only benefiting from the growth programs. Lower social, sustainability and consumer protection standards give them additional cost advantages.

Europe – an aviation location in competition

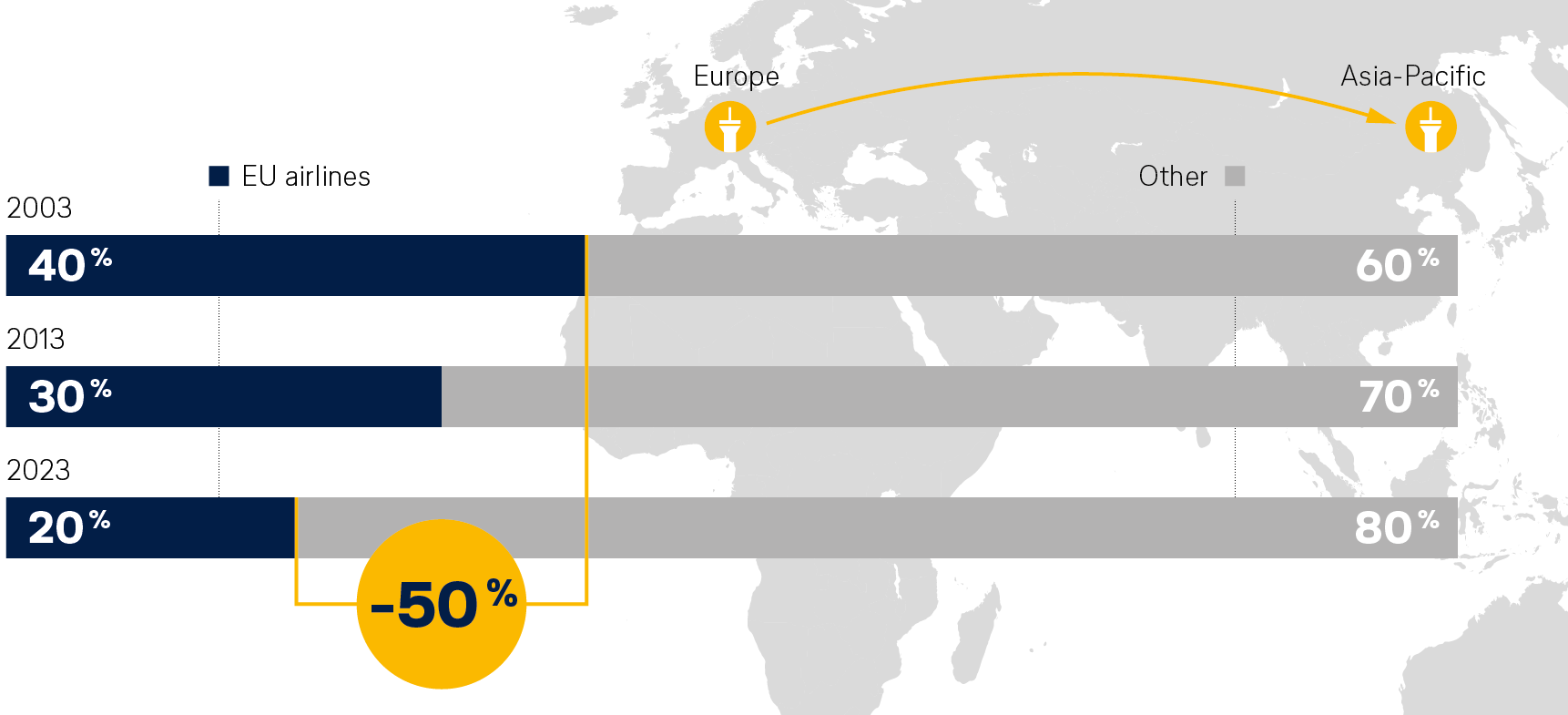

EU airlines are losing market share on routes from Europe to Asia

Sources: own calculations, IATA DDS

Policies drive up location costs

Numerous EU regulations exacerbate the competitive disadvantages. In particular, the measures adopted as part of the European climate protection package “Fit for 55” (ETS reform and SAF quota) place a one-sided burden on EU airlines compared to their non-European competitors without bringing any significant benefit for the environment. This is because they harbor the risk that passengers will increasingly use cheaper connections via hubs outside the EU in the future, which will not save CO2 emissions, but only shift them (“carbon leakage”). Without the necessary corrections, the market shares of European airlines will continue to decline - at the expense of value creation, jobs and connectivity.

In Germany, the international competitiveness of aviation is suffering in particular. Flights to and from Germany are the most expensive in the EU. Taxes and fees at German airports have almost doubled since 2019. While most European countries have already reached pre-crisis levels by 2023, the number of seats offered by airlines in Germany at the beginning of 2025 was only around 86 percent compared to before the coronavirus pandemic.

Expensive aviation location

When a medium-haul Airbus A320neo jet took off from Stuttgart, Frankfurt or Düsseldorf in February 2024, around 4,000 euros in government charges* were due. In contrast, the same flight from Madrid or Barcelona was only charged 600 euros.

* Aviation tax, aviation security charges, air traffic control

Sources: BDL, DLR

Realigning aviation policy

Domestic network airlines and hubs are economically and strategically crucial for the EU and its member states. They secure Europe's connection to the world and thus its sovereignty. Brussels and Berlin must therefore urgently strengthen the competitiveness of European air traffic. This is essential:

- Introduce competitiveness checks: How do new regulations affect competitiveness of domestic airlines? This check must be a central part of future legislative processes.

- Implement regulation in a competition-neutral way: Air traffic is global, EU airlines compete with providers from Turkey or the Gulf region, particularly for long-haul connections. Regulation must always take this into account.

- Making use of aviation agreements: International air traffic is based on international agreements. These aviation agreements must take social, environmental and consumer protection standards into account. At the same time, violations must be consistently sanctioned.

- Enabling consolidation: Large airlines have clear advantages when it comes to leveraging synergies, investing in more economical fleets and surviving global competition. Politicians must therefore support the consolidation of the European airline market – which is extremely fragmented compared to the USA or China, for example.

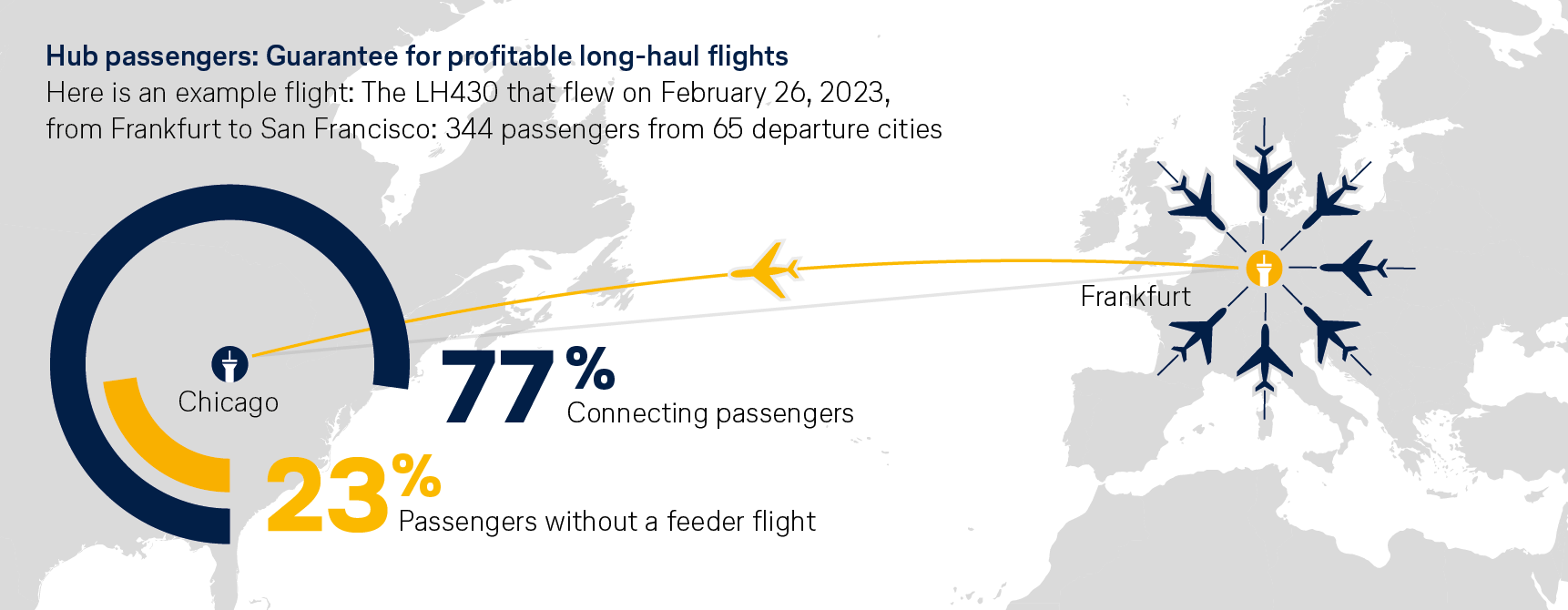

The hub system: efficient travel on long-haul routes

Direct flights are the first choice for shorter routes in Europe. Intercontinental travelers usually board at a hub. The so-called hub system enables a wide range of long-haul connections that would not be possible with direct flights alone. The combination of transfer and local passengers optimizes the utilization of long-haul flights – this makes economic and ecological sense.

Economic significance of air traffic

The European aviation sector directly employs 1.4 to 2.2 million people and supports up to 7.5 million jobs in total. The direct contribution of aviation to the EU's GDP is 110 billion euros. Aviation is also a key driver of European tourism, which accounts for around 10 percent of the EU's GDP. (sources: BDL, EU, Factsheet on Tourism 2024)

![[Translate to EN:] [Translate to EN:]](/fileadmin/user_upload/policy_hub/themen/wettbewerb/wettbewerb_header_v2.jpg)